In 2015, the domestic lysine market was in a malaise, mainly because of oversupply, according to CCM. Even though mainstream manufacturers attempted to raise prices by reducing production, the effect was minimal and short-lived. It’s estimated that the 2016 China’s lysine market will be a continuation of the market downturn experienced in 2015.

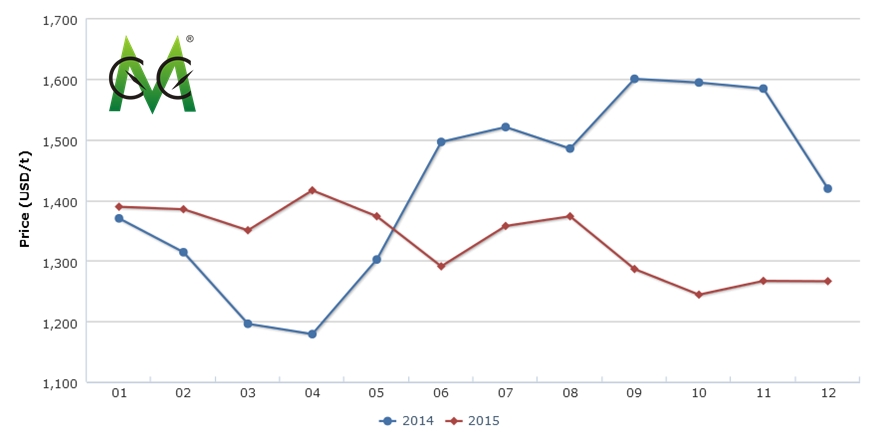

2015 witnessed a sluggish lysine market in China. Particularly in Q2, when the lysine price fluctuated wildly. The market price of 98.5% lysine was USD1,416/t in April and fell by 9% to USD1,291/t in June, according to CCM’s price monitoring.

Overcapacity was the main reason for the fall in the lysine price. China is the largest lysine manufacturer in the world, and in 2015 its total capacity exceeded 1,800,000 t/a, while consumption was approximately 700,000 tonnes.

Lysine overcapacity caused the price to fall, having a knock-on effect on the performance of the chief domestic manufacturers. A key example is Global Bio-chem Technology Group Co., Ltd. (Global Bio-chem), whose H1 financial figures reflect:

-

Revenue: USD204.43 million (HKD1.59 billion), down by 56.46% YoY

-

Net profit: -USD125.11 million (-HKD971 million)

Manufacturers' profit margins were being squeezed, the cost price was even higher than the sale price of lysine. Therefore, manufacturers were overburdened and had no choice but to reduce production to raise quotations. CCM's investigative findings:

-

Global Bio-chem: all its lysine production lines were shut down in March due to company reorganization. It subsequently partially restarted some production lines in Nov.

-

CJ Group Co., Ltd.: its two Chinese factories, namely CJ (Shenyang) Biotech Co., Ltd. (capacity: 100,000 t/a) and CJ Liaocheng Biotech Co., Ltd. (capacity: 150,000 t/a), have suspended production since July, due to factory overhauls. The actual output was only 20% of the company’s capacity.

-

Ningxia EPPEN Biotech Co., Ltd. (EPPEN Biotech): it planned to cut its operational output to 50% from July onwards. (capacity: 210,000 t/a)

Decreasing supply propelled the lysine price up. CCM’s price monitoring showed that the market price of 98.5% lysine was USD1,373/t in Aug., growing by 6% from June.

However, the price increase was but a flash in the pan. Beginning in Sept., the lysine price declined. The market price of 98.5% lysine was USD1,286/t, down by 6% MoM. Subsequently, the lysine price remained at this low level until Dec.

Despite the influence of reduced production, the lysine price continued to fall. In Sept., the government lowered the purchase price of corn (for temporary storage) to USD308/t (RMB2,000/t) in China, the market price of corn fell by 10% MoM to USD337/t as a consequence. In Dec., the market price dropped to USD297/t. Decreasing raw material prices have dragged down the price of lysine.

Monthly market price of 98.5% lysine in China, Jan. 2014-Dec. 2015

Source: CCM

It’s been predicted that the lysine market will continue to be in a downturn in 2016.

Overcapacity still exists

Even though Chinese lysine manufacturers had the intention to control output and reduce capacity, the lysine industry is still overcapacity. Notably, Global Bio-chem resumed lysine production in Jan. 2016, which should further pressurize the lysine market.

Oversupply of corn is likely to cause price to fall

It’s estimated that the annual stock of domestic corn will reach as high as 800 million tonnes in 2016, which can satisfy an 8-month demand in China. Such huge stock will inhibit the price of corn from rising. This signifies that the falling cost of corn is unable to aid the growth of lysine price.

If you need more information about lysine in China, why not get a free-trial of CCM’s Online Platform? You can get much more information about lysine or even the whole amino acid market for free!

GET FREE TRIAL NOW!

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: lysine